Nigeria’s Digital Economy is Setting the Standard in Africa

When you account for Nigeria’s population size, it slips down the list slightly, with a GDP per capita of US$5,362.80, putting it in 20th place. Though being the nation with the biggest population on the continent skews this against Nigeria’s favour somewhat.

Nigeria has a lot of room to grow though, thanks in part to the country’s mixed economy, with strong and developing manufacturing, financial service, technology, and entertainment sectors. For decades, the country has relied on the export of fossil fuels, despite producing only 2.7% of the world’s supply of oil.

The government’s tax revenues are heavily dependent on oil, though a lot of effort is going into diversifying this more and more.

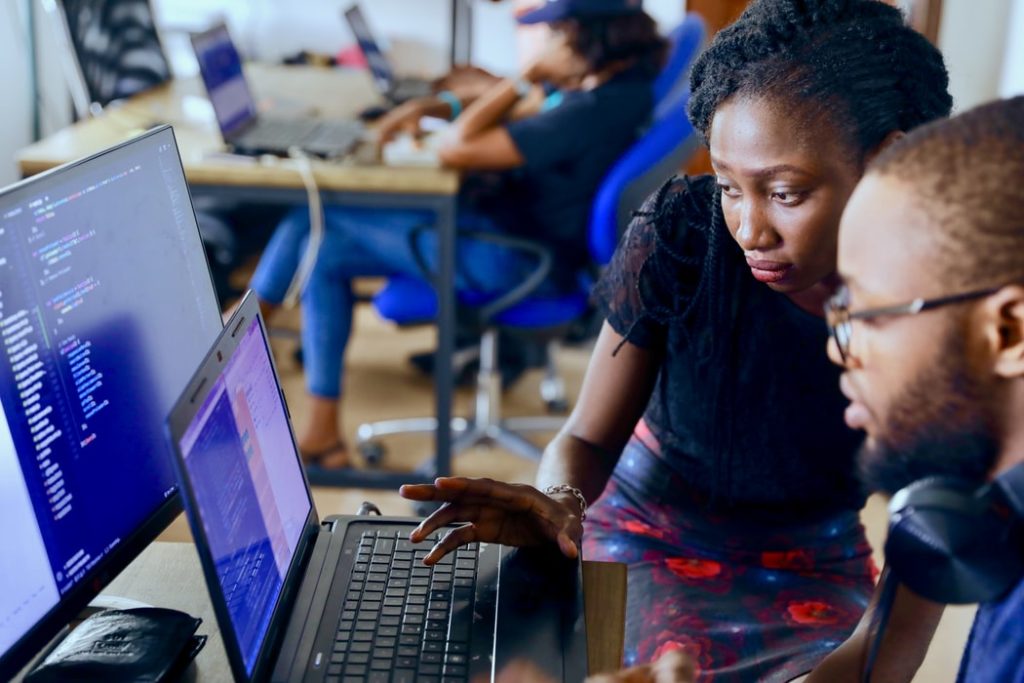

To achieve this, digital products and services are an area that is receiving a lot of focus. This is helped by the fact that Nigeria has a young population that is centred mostly in cities, which makes the adoption of new technologies easier.

Nigeria’s strong digital sector is something it can be proud of and something that other African nations can learn from.

Streaming

Streaming services have enjoyed explosive growth around the world, though Africa has lagged behind other continents. This is changing though, with spending on music streaming services expected to rise to US$40 million by 2023. PwC has forecast that Nigeria will become the fastest-growing streaming market in the world, with a compound annual growth rate (CAGR) of 39.6% between 2020 and 2025.

The rise of streaming services in Nigeria has also been helped by free services like Audiomack, which recently signed a deal with Warner Music Group that covers Nigeria and four other African countries. It also lets local talent like Laycon get exposure that they may not otherwise have achieved.

With an internet penetration rate of around 50% and a smartphone adoption rate of more than 90%, there is a huge market ready and waiting for streaming companies.

This has also led to a rise in online advertising, which now generates more revenue than traditional television advertising in the country.

Gaming

Gaming is an area where Nigeria is particularly strong. It has one of Africa’s largest video game markets, with more than $120 million of revenue in 2018 alone. Just about every genre and format is available in the country thanks to its favourable regulatory environment, strong economy, and robust digital infrastructure.

Like elsewhere in the world, PC and console gaming is popular having had much longer to build a following among the gaming community. Though the dominance of these two platforms is being challenged.

Casual games, such as digital versions of popular card games like blackjack and puzzle games like Wordscapes have helped to make mobile gaming much more popular in the country. In 2015, app-based mobile gaming revenue was just $7.9 million but by 2019, this had grown to $53 million.

Cashless Payments

The Nigerian economy has relied on cash for a very long time, lagging behind other nations in terms of electronic transactions like digital banking and credit and debit card payments. While cash works great for many Nigerians, it does leave some people unable to access important services.

In 2014, around 60 million Nigerians lived in rural areas, with 28.6 million of them being classed as “financially excluded”. A further 8.4 million Nigerians living in urban settings were also categorised in this way.

In the seven years since, policymakers, financial services companies, and entrepreneurs have been working hard to let more Nigerians get access to financial services. It’s introduced a national ID card that can be used for payments, introduced fees that incentivise cashless transactions for larger businesses, and introduced payment wallet services.

Two-third of salaries from large businesses are now paid electronically, compared to just 15% in smaller firms. The figures are rising year-on-year though, as more people learn about the convenience of cashless transactions.

Connecting rural Nigerians to the financial system also allows them to improve their own businesses and reduce the financial inequality in the country. Combined with online trading platforms, it allows them to transact with more customers and get paid more easily and safely.

As of 2019, Nigerians were making 300 million digital transactions each month, a figure that continues to rise today.