Nigeria records fewer internet users but higher data consumption

Nigeria’s active internet subscriptions across mobile, fixed, and VOIP networks fell to 141.1 million in June 2025, marking a 0.3% drop from 141.5 million recorded in May, according to the latest industry statistics from the Nigerian Communications Commission (NCC).

The NCC report shows that mobile operators, MTN, Airtel, Globacom, and T2 (9mobile), continued to dominate the market with 140.6 million internet subscriptions, leaving internet service providers (ISPs) and others with 528,633 users.

While subscriptions dipped, data usage climbed slightly. Nigerians consumed 1.044 million terabytes of data in June, marginally higher than the 1.043 million terabytes recorded in May, which itself had been the highest monthly figure since January 2023.

Industry players say this growth reflects the surge in connected devices and online activities, especially in urban centres. T2’s Chief Executive Officer, Dinesh Balsingh, noted that “cities like Lagos are growing at lightning speed, more people, more businesses, more devices,” adding that telcos are investing heavily to expand network capacity.

Mobile subscriptions are also on the decline

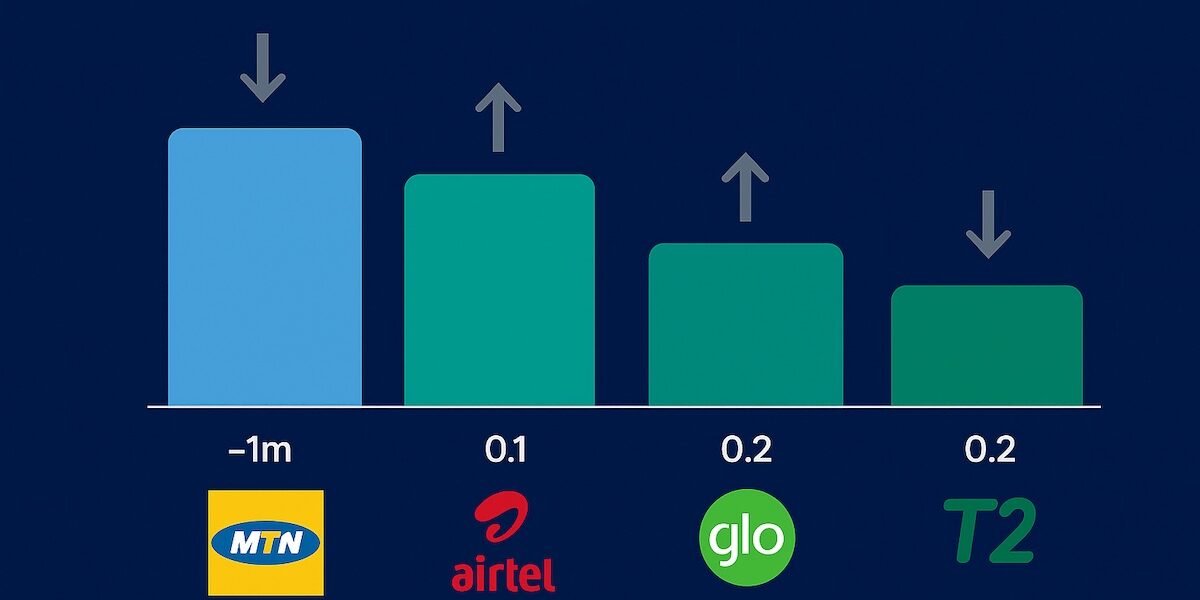

Overall, total active mobile lines fell to 171.5 million in June from 172.4 million in May, driven mainly by a sharp drop in MTN’s subscriber base. MTN lost 1 million active lines, bringing its total to 89.2 million.

Data showing the changes between May and June 2025:

| Metric | May 2025 | June 2025 | Change | Notes |

|---|---|---|---|---|

| Active internet subscriptions (total) | 141.5m | 141.1m | -0.3% | Across mobile, fixed, and VOIP networks |

| Mobile internet subscriptions (MTN, Airtel, Globacom, T2) | 141.0m | 140.6m | -0.3% | Dominated by 4 major operators |

| ISP & others | 532,479 | 528,633 | -0.7% | Small share of market |

| Data usage (terabytes) | 1.043m | 1.044m | +0.001m | Slight increase despite subscription drop |

| Total active mobile lines | 172.4m | 171.5m | -0.52% | Decline led by MTN |

| MTN subscribers | 90.2m | 89.2m | -1.0m | Still the largest operator |

| Airtel subscribers | 58.86m | 58.9m | +36,316 | Gained subscribers |

| Globacom subscribers | 20.6m | 20.8m | +263,028 | Highest monthly gain |

| T2 (9mobile) subscribers | 2.6m | 2.4m | -236,238 | Significant drop |

| MTN market share | — | 52.03% | — | Largest share |

| Airtel market share | — | 34.38% | — | Second largest |

| Globacom market share | — | 12.18% | — | Third |

| T2 (9mobile) market share | — | 1.42% | — | Smallest |

| Teledensity | 79.65% | 79.22% | -0.43pp | Drop reflects fewer active lines |