How to Apply for NELFUND Student Loan in 2026: Step-by-Step Guide

There is no excuse for dropping out of a tertiary institution in Nigeria, especially if you lack cash and can apply for Nelfund student loan. If you or your parents cannot pay the tuition, consider applying for scholarships, bursaries, or grants. If you do not receive any, you may apply to the Nigerian Education Loan Fund (NELFUND).

The NELFUND Student Loan pays your tuition and gives a monthly “upkeep” to meet your living expenses. So far, over 600,000 Nigerian students from universities, polytechnics, and institutions of education have taken advantage of this chance.

Applicants submit their applications using the NELFUND portal, using their JAMB or matric number. It pays school costs and optional expenses, and repayment begins two years following NYSC.

What is a NELFUND Student Loan?

The NELFUND Student Loan is an interest-free loan issued by the Federal Government of Nigeria to assist students in public tertiary institutions with their academic fees and living expenses. The initiative is run by the Nigerian Education Loan Fund.

The loan program gives 0% interest to both new and returning students, is open to university, polytechnic, college of education, and vocational school students, includes institutional expenses and optional upkeep, and is repaid two years after NYSC completion. The goal is straightforward. No Nigerian student should be denied an education due to financial difficulty.

Portal Opening for Nelfund Student Loan 2025 and 2026 Academic Sessions

NELFUND has announced that the student loan site will be open for the academic years 2025 and 2026.

Application period: Thursday, October 23, 2025, to Saturday, January 31, 2026.

Institutions must submit verified student data to the NELFUND Student Verification Portal before their students can apply. This applies to both returning students and newly admitted candidates.

New students can apply with their admission number or JAMB registration number. Institutions that have not yet begun their academic sessions must submit their academic calendars to NELFUND for scheduling flexibility.

Who Can Apply for NELFUND Student Loan? Eligibility Requirements For 2026

You are eligible for the NELFUND Student Loan if you meet the requirements listed below.

1. You must be a Nigerian citizen.

Only Nigerian students attending authorised public tertiary institutions are eligible.

2. You must be a student at a public university.

This includes:

- Federal and state universities

- Polytechnics

- Colleges of education

- Technical and vocational schools

- Part-time and full-time students may apply as long as they have a JAMB number.

3. Your institution must upload the data.

If your school has not posted your information to the NELFUND dashboard, you will be unable to apply.

4. You should not have defaulted on any loans.

Students with delinquent debts from any licensed financial institution are ineligible.

5. You must not be convicted of fraud-related offences.

Disqualifying offenses include:

- document falsification

- exam malpractice

- forgery

- drug crimes

- cultism

6. There is no income restriction

The previous household income limit has been eliminated. Any student who meets the other conditions may apply.

7. There is no age limit.

Older students returning to school may also benefit.

Documents Required for Applications

Before you begin your online application, make sure you have the following items ready.

- JAMB admission letter

- National Identity Number

- Bank Verification Number

- Matriculation number (new students can use JAMB number)

- Valid email address

- Valid bank account number

- Student ID card (optional)

- School fee invoice (optional)

- Upload only clear scanned copies.

How to Apply for NELFUND Student Loan in Nigeria

Here’s a step-by-step guide to applying for a student loan using the NELFUND Portal:

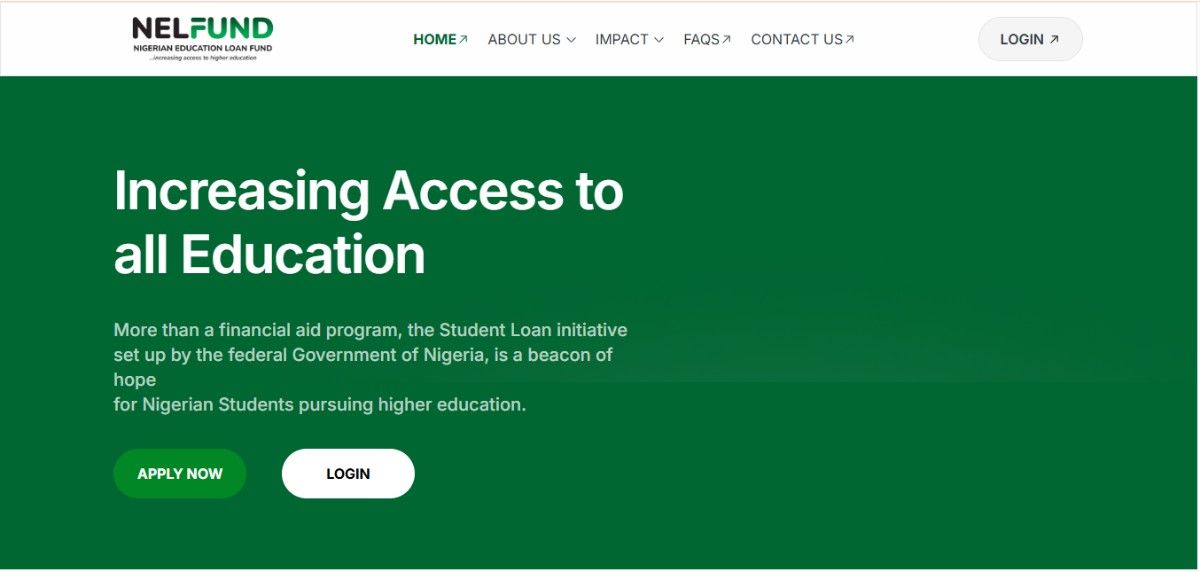

Step 1: Create an Account.

- Visit the Nigerian Education Loan Fund’s website.

- Click “Apply Now” to go to the NELFUND Portal.

- Click “Get Started”

- Answer the questions on this page and then click on “Yes, I am a Nigerian”.

- Verify your educational details. To see if your school has uploaded your information, select it from a dropdown list and enter your matric number.

- Click “Verify with JAMB” and input your JAMB information on the screen.

- To create an account, enter your email address, password, and confirm password in the supplied forms and click “Create Account”.

- Click the email verification link that was delivered to your inbox.

Step 2: Complete Your Profile

- After successfully registering, log in by clicking the “LOGIN” button.

- To log in, enter your email address and password.

- Click the “Proceed to Contact Details” button.

- Update your contact information to include your current phone number, full residential address, state, and local government area of residence.

- Update your educational details by selecting your Higher Institution and entering your Matric Number, then click “Proceed to Account Details”.

- Enter your BVN, then select your bank name and account number to verify it. Click “Save Changes” to finish your profile.

Step 3: Loan Application

- After logging in to the application, click the “Request for Student Loan” button in the upper right corner of the house or loans page.

- If you want an upkeep loan, tick the box and click Continue; if you only need the institutional fee, hit the “Continue” button.

- Please upload supporting documentation (student ID card and admission letter).

- The admission letter is required; however, the student ID and institution invoice are optional.

- Click the checkbox for the policy and declaration, and then click “Continue”.

- Read the loan overview and click the checks for both the Terms & Conditions and the GSI Mandate, then click “Submit Application”.

Frequently Asked Questions

How to apply for a 2025 student loan?

- Visit the official NELFUND website. Navigate to https://nelf.gov.ng/

- Initiate the application process

- Begin registration

- Confirm eligibility

- Verify educational information

- Authenticate with JAMB

- Create your account

- Verify your email

How long does Nelfund take to approve a loan?

NELFUND loan approval typically takes 3 to 6 weeks, but can vary; it includes initial verification, then sending details to your institution for confirmation (2-3 weeks), and finally NELFUND’s internal approval before disbursement within 30 days of final approval, with delays frequently due to slow school verification or data issues.

How much is Nelfund giving to students?

NELFUND (Nigerian Education Loan Fund) provides loans for institutional fees and an optional ₦20,000 monthly upkeep stipend to eligible students in public universities. By late 2025, total disbursements will exceed N140 billion, covering tuition and living costs for nearly 800,000 students.

Is NELFUND still ongoing for 2025-2026?

The 2024/2025 portal will close on September 30, 2025. No additional student applications will be accepted beyond this date. The portal will reopen in the second week of October 2025 for new applications for the 2025/2026 academic year. This cycle will be open until January 2026.

Conclusion

To apply for Nelfund Student loan is one of the most effective ways for Nigerian students to support their studies without incurring significant debt. Your application will be processed smoothly as long as you complete the necessary processes and meet the qualifying requirements.