How to Apply for Moniepoint Loan: Requirements, Eligibility and Step by Step Guide

Moniepoint has developed to become one of Nigeria’s most trusted fintech platforms, serving millions of people and small companies. Known mostly for its dependable Point of Sale (POS) terminals and agency banking solutions, many Nigerians are now asking, “How to Apply for Moniepoint Loan” If you want a clear and accurate answer, you’ve come to the perfect place.

This article describes how to apply for moniepoint loan, whether you are a POS agent, a small business owner, or a regular user. With Nigeria’s growing need for fast and accessible funding, it’s critical to understand the options available and avoid misleading claims. We’ll walk you through all you need to know, from Moniepoint’s formal loan services to alternative financing options on the platform.

What is Moniepoint, and How Does it Work?

Moniepoint is a licensed financial technology firm and digital banking platform in Nigeria run by TeamApt. Moniepoint was originally recognised for enabling Point of Sale (POS) systems, but it has since evolved into a full-fledged business banking provider, including solutions for money transfers, deposits, bill payments, and financial management, particularly for small and medium-sized enterprises.

Moniepoint facilitates agency banking by allowing independent agents to deliver financial services to Nigeria’s unbanked and underbanked populations. These agents use Moniepoint POS machines to process cash withdrawals, deposits, transfers, and other transactions.

Aside from POS services, Moniepoint now provides business accounts, automatic transaction reporting, customer support, and an ecosystem for business growth. This makes it more than just a payment option; it’s a vital player in Nigeria’s campaign for financial inclusion.

However, when it comes to borrowing money, many customers are uncertain whether Moniepoint offers direct loans, agent credit, or company finance. That is what we will discuss in the next section.

Can I Apply for Loan from MoniePoint?

Yes, you can borrow money from Moniepoint, but only if you run a registered business. Moniepoint provides business loans designed to help Nigerian small, medium, and large enterprises expand and operate more effectively. These loans are not intended for personal use and are not available to those who do not have a company activity.

According to Moniepoint, their loan solutions are designed to assist business owners with:

How to Apply for Moniepoint Loan: Requirements

- You could be a Nigerian citizen or resident.

- At least 18 years old

- A monthly income stream.

- Attach your ATM card to the account.

- Give information about your two closest relatives, including phone numbers.

- You have a great credit score and no outstanding loans with other lenders.

- Maintain an active bank account.

- Your BVN must include your phone number.

- You must have a valid government-issued ID card.

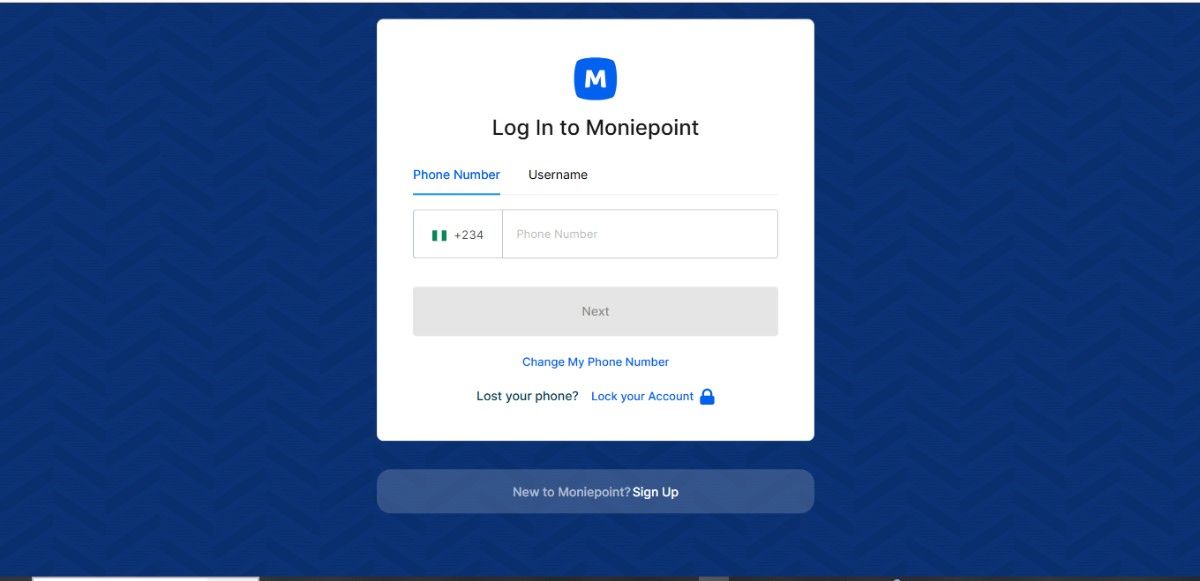

How to Apply for Moniepoint Loan: Step-by-Step Guide

Here’s a step-by-step approach to getting a Moniepoint loan.

- Visit the Moniepoint web application portal.

- To log in, enter your Moniepoint login and password.

- Select Outlet Manager and then click “Next.”

- You may view the recommended loan amount by scrolling down.

- Select “Apply for a Loan”.

- Enjoy personalized loans.

- Your loan limit rises in proportion to the number of withdrawal transactions you complete.

Conclusion

Thank you for reading this article until the end. I believe you now have a decent idea of how to borrow money with Moniepoint!

Borrowing money from Moniepoint is a wise decision, but only for legitimate firms aiming to expand and scale responsibly. Moniepoint has established itself as one of the most business-friendly lenders in Nigeria’s fintech market, thanks to its simple loan application procedure, low documentation needs, and flexible repayment alternatives.

However, it is vital to note that Moniepoint does not yet offer personal loans. Their credit services are exclusively intended for small, medium, and big businesses, not individual borrowing. If you qualify, you may apply quickly and easily through their website or mobile app, and once granted, funds will be transferred immediately to your business account.